Manually Updating NannyPay2

Updating NannyPay2 Salary Records

Overview

If you have been paying your household employee before you began using NannyPay2 software, you may wonder whether it is necessary to update your computerized records with your previous manual payments and withholding records. Of course, the easiest approach is just to begin using NannyPay2 and worry about your previous records when you pay the government. However, this approach may not be consistent with either good business sense or your temperament. If that is the case, we recommend following one of several updating options:

1. The Automatic Approach

You can reenter each previous transaction by using NannyPay'2s automatic calculation features. Just set the appropriate federal, state and payment settings, and calculate the withholding by entering the appropriate pay period for each transaction. The drawback to this approach is that it may not accurately reflect the exact amounts actually paid to your household employee, particularly if you have been previously using the federal or state manual wage-bracket withholding tables. NannyPay2 calculates withholding based upon the percentage method, which is more accurate than using wage-bracket tables. Therefore, NannyPay2's automatic calculations may not exactly match your previous manual calculations. For tax payment purposes, this discrepancy is not important, however, your new records will not accurately reflect amounts actually withheld and paid.

2. The Full Manual Approach

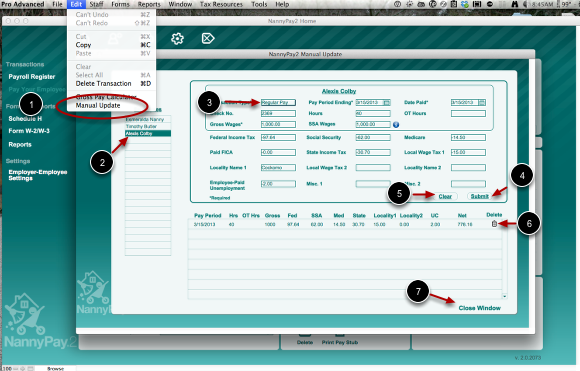

You can manually reenter each previous transaction, using NannyPay2's manual update utility, found in the "Edit" menu (illustrated below). While this method is the most accurate updating approach, it is tedious. You must gather your previous records, and enter the amounts of tax withheld for each withholding category (e.g., Social Security, Medicare, state and federal income tax, etc.) for each pay period. This method will insure that your weekly, year-to-date, and quarterly records will be accurate.

3. The Quarterly Approach

You can manually reenter previous transactions, again using NannyPay2's manual update utility (illustrated below), but limiting the entries to quarterly totals for each withholding category. Using this approach, you must total all previous withholding by category and by quarter and manually enter the totals according to the appropriate quarterly date: March 31st, June 30th, September 30th, or December 31st. Using this method, you maintain the accuracy of the quarterly totals. You can vary this approach by only entering gross and net pay, if the details are not important to you. Note that if you use this method, your employer liability reports for withholding and contributions may not be accurate.

4. The "Gross/Net" Approach

You may manually enter only the total gross and net salary paid to your household employee from the first of the year to the time you began using NannyPay2. You can date this transaction using the current date. This may be the simplest approach, however, you must keep in mind that your year-to-date and quarterly totals will not accurately reflect the amounts paid to your household employee or previous withholding.

How to Manually Enter Transactions into NannyPay2

The NannyPay2 Manual Update utility provides you with the ability to manually enter withholding calculations so that they are reflected in the year-to-date and quarterly records generated by NannyPay. This is particularly useful if you have been paying your household employee before you began using NannyPay2 software and you wish to update your computerized records with your previous manual records. To use the Manual Update utility, follow these steps:

1. Launch "Manual Update": To view the Manual Update utility screen, select "Manual Update" under the "Edit" menu.

2. Select your employee: From the employee list, select the employee for whom you wish to enter a manual payroll transaction. If the employee does not appear on the list, you must add the employee to the NannyPay2 database.

3. Fill in the relevant fields: Starting with "Transaction Type," fill in each field with your keyboard. You can move from field to field with the tab key or simply use your mouse. You do not need to fill in fields that do not apply to your employee.

4. Click "Submit": When you are finished filling in the relevant transaction information, click on the "Submit" button and your transaction will appear in the grid below the data entry fields.

5. Clear: You can clear all the entries you made in step 3 with a single click of the "Clear" button.

6. Delete: if you made a mistake or you wish to remove a manual update transaction for another reason, click the "Delete" button.

7. Close: To close the Manual Update utility, click the "Close Window" button.