Entering Miscellaneous Deductions and Adjustments

To Enter Miscellaneous Deductions and Adjustments

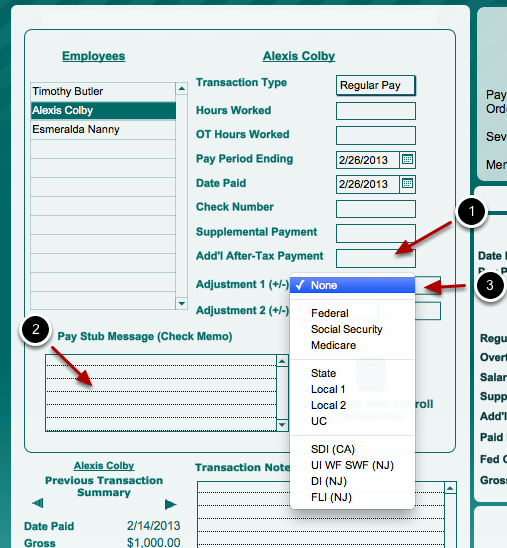

1. Non-Taxable Payments. You can enter a miscellaneous non-taxable payment by entering a positive amount in the Additional After-Tax Payment box. For example, if you wish to reimburse your employee for an expense she incurred, simply add a positive amount in the Additional After-Tax box.

2. Pay Stub Message. Annotate the reason for the additional payment as a Pay Stub Message, which will appear on your employee's pay stub.

3. Adjustments. The appropriate way to correct a withholding error or change once your employee has been paid and issued a check is to provide her an adjusted pay check for the following pay period. To make an adjustment, enter a positive or negative amount in the Adjustment box and classify the adjustment according to the appropriate withholding category as illustrated above. NannyPay2 permits you to make two adjustments per payroll transaction. The adjustment will be reflected on your employee's pay stub and you can provide additional information as a Pay Stub Message.