Calculating Payroll Transactions

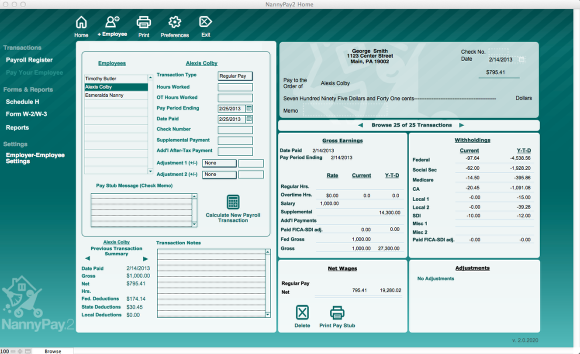

The Home Screen - Overview

After setting up NannyPay2, the software's home screen will automatically appear as illustrated above. From this location you can enter all your pay period information; calculate your household employee's payments and withholding; view and delete previous payroll transactions; print checks or pay stubs; and change employees.

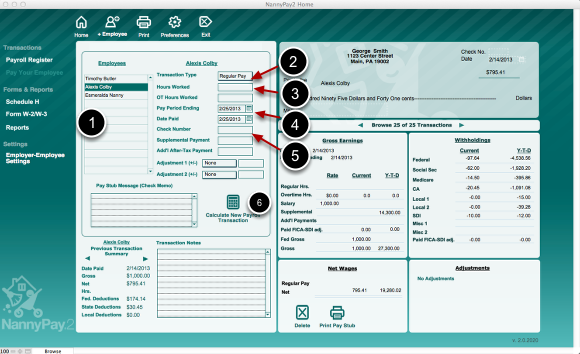

To calculate a payroll transaction:

To set up a payroll transaction, use the employee specific settings on the panel to the left of the pay check image. These include transaction type, hours worked, salary, pay period, date paid, check number, etc. The numbered parts of the diagram refer to the steps below.

1. Choose an employee by selecting his or her name on the Home screen's employee list;

2. Change the transaction type, if necessary;

3. If your employee is an hourly worker, enter the number of hours worked. If his or her pay check include over time hours, enter those, also;

4. Enter the pay period ending date and the date paid;

5. Finally, if you are paying your employee with a check, enter the check number. You can also enter the check number later by navigating to the payroll transaction and entering it directly in the appropriate space in the check image; and

6. Click the "Calculate Payroll" Button. View the gross earnings and withholding amounts under the pay check image to the right on the Home screen. The Date Paid and Pay Period Ending dates for the most recent payroll transaction will appear in red.