Five-Year Nanny Tax Payroll Competitor Cost Comparisons

Easy to Use Nanny Payroll Software

Child Care | Senior Care | Pet Care | Housekeeper

NannyPay is secure and cost-effective nanny tax payroll management software for calculating taxes for your nanny, babysitter, housekeeper, personal assistant or any household employee. More than just a tax calculator, NannyPay will maintain all your nanny tax payroll records.

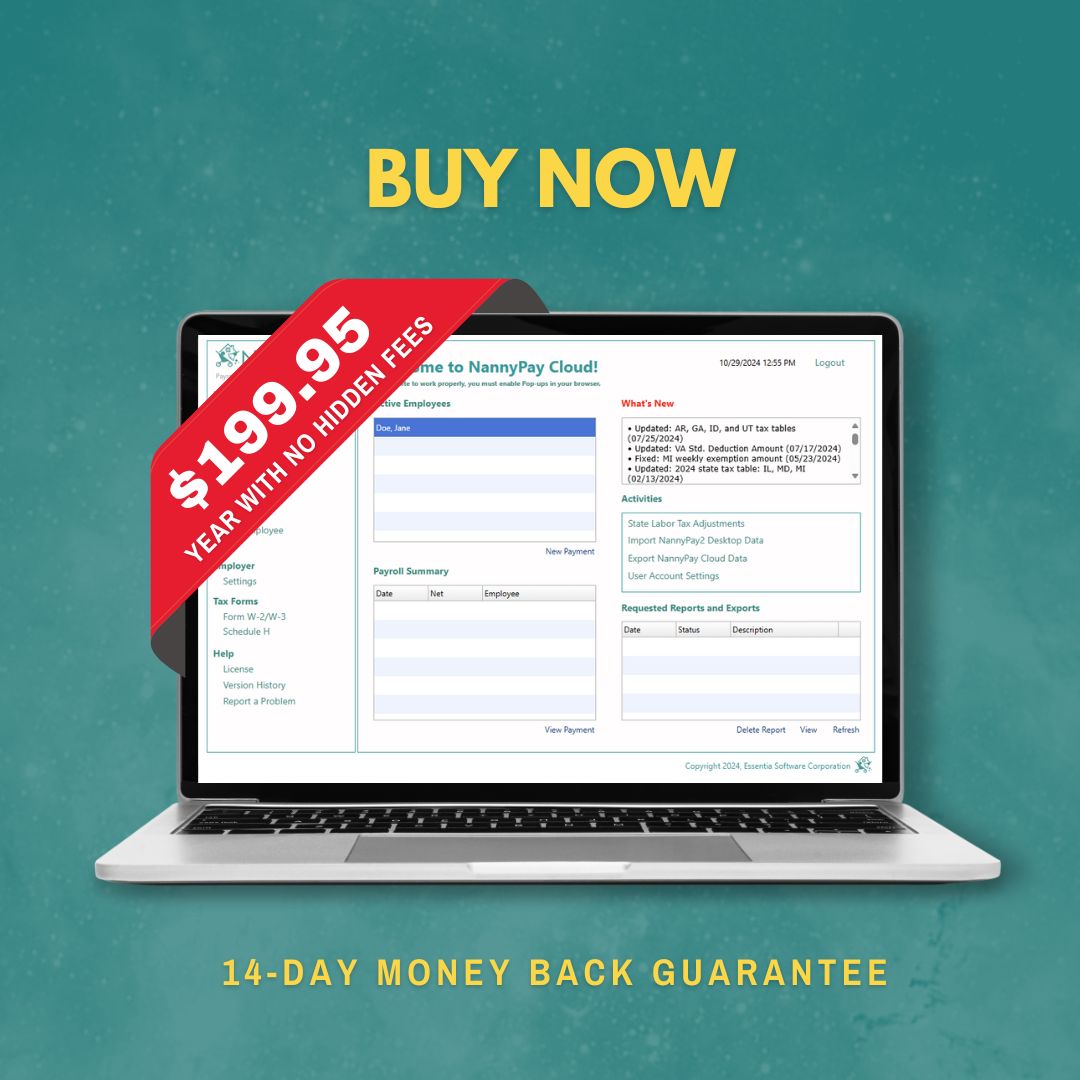

NannyPay nanny tax software will save you thousands of dollars over popular nanny tax payroll services, our competitors. Our software is available via the Cloud.

Household Payroll Software Benefits…

Latest News from NannyPay

The Federal Employees Return-to-Work Mandate

The Federal Employees Return-to-Work Mandate: What It Means for Parents and the Importance of Paying Your Nanny Legally For [...]

Do You Owe The Babysitter Tax?

Paying someone to watch your child may seem like a routine affair, but technically you probably become an employer [...]

DIY Software vs. Full-Service

In the realm of household payroll management, finding the right solution to ensure both compliance and convenience is crucial. [...]

Paying Your Pet Sitter Over the Table

The Smart Choice for You and Your Furry Friend Pets are like your kids and it's not surprising that [...]