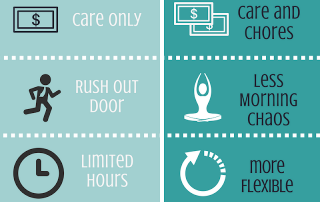

Nanny Care vs. Day Care

Transitioning to Nanny or Daycare Your bundle of joy has arrived and you and your partner couldn’t be more excited. You are finally starting to get into a routine when reality hits: it’s time to start thinking about going back to work. Most mothers are not emotionally ready for this transition which can make this decision very stressful and confusing. Some people are lucky enough to have family who are willing to help, but for most people, it’s between hiring a nanny or sending their child to daycare. This can be a daunting process, however, it doesn’t have to [...]